Abstract

Last years, we’ve heard about Blockchain as one of the most disruptive technologies. Blockchain is , breaking news related to it are flourishing and almost all technology main actors are developing or updating their solutions to harness Blockchain technology.

This is an Interview-Based article to Mr. Hicham QAISSI, professor of Business Intelligence and Blockchain in the MBAi of IEN-UPM Business School, belonging to the prestigious Polytechnical University of Madrid, Spain. QAISSI will unveil this costly understanding world and give a great overview of Blockchain technology since Business outlook.

With this Interview-based article you will learn what a business man, entrepreneur or manager should know about Blockchain, how this new technology help them to bring their business to higher level and how it is changing and rethinking value chains in many sectors.

Interviewer: Hicham, thank you to give us this opportunity to shed some light on this confuse world. Please, bear in mind this interview if for non-technical managers, so in order to give it a good acceptance I appreciate not deepen into technical concepts.

Hicham: The pleasure is mine. Thank you to give me this chance to share my thoughts and stories with you and readers. I’ll try to give you a good and well-off overview without immersing under the hood.

Question: Hicham, I’ve tried to find a simple definition of Blockchain that doesn’t confuse and without enter into technical details, but trust me, with no much success. Please, can you give us an abstract idea about what Blockchain is?

Answer: You are right, it seems that experts don’t want people of other sectors or backgrounds to know what Blockchain is. Simply put, Blockchain is a new type of database. It stores data in such a way backing it with some new special features that endorse it with security, immutability and trust. This data is distributed and available in a public ledger. New chunks of data are added to the ledger one by one like a stack and each chunk is somehow related to the previous one. To add new chunk of data, all nodes in the network have to accept it, agree it haven’t been any change in the past and the chain of data chunks haven’t been manipulated.

I say it in all interviews and classes, the best definition of Blockchain is the one Dan Tapscott mentioned in his book “Blockchain Revolution” (ISBN 978-1101980149): “a vast, global distributed ledger or database running on millions of devices and open to anyone, where not just money, but anything of value: titles, deeds, identities, even votes can be moved, stored and managed securely and privately. Trust is established through mass collaboration and clever code rather than by powerful intermediaries like governments and banks”.

Question: Gee,let me see, all this hype is about a new type of database?

Answer: Saying that Blockchain in a new kind of database is the same than saying e-mail technology is a new way to send letters. In the end, the main purpose is to send information, but in a different way. In Blockchain, the same, the purpose is to store data endorsing it with security, transparency and trust.

Question: Ok, now, if I ask you how does the Blockchain work without going into technical specifies, am I asking too much?

Answer: Blockchain could be explained from two perspectives, technical and abstract (business perception) perspectives. Having into account this interview is for a Business School, I imagine you are more interested in the first one.

As analogy, we can imagine the Blockchain as an accountant ledger, in each page, operations are registered starting with the result of the previous page (as a chain). With this mechanism, it’s easy to realise that the attempt to change a single operation in any page, it also entails modifying all successive pages. And having into account the huge number of distributed copies (one copy per each user in the net), trying to modify transactions in a chain of blocks could be a titanic task, if not impossible.

Now, we can allocate a person to manage this ledger, but in this case, we are having a centralized and private database and, we could have a problem, this person or whoever has access to the database can make any change in their benefit because they are the only one having access to the database.

Solution: If this ledger is public and distributed, we are in an open network and each node has access to the ledger, they can see each change in the ledger, add new transactions and even check whether the sum is correct or not, and only the last version could be considered as correct if it’s accepted by the majority of nodes. If these rules are met, nobody could alter the historic transactions of the ledger and distribute it as a new manipulated version because the majority of nodes won’t accept it. Each time a node in the net tries to add a transaction or a set of them (bloc), it is notified to all nodes to update their ledger. In case of involuntary error or malicious intention, the new transaction will be rejected. This way, there is no centralized database and we have no necessity of an institution to control the ledger, all members manage the same version of ledger.

Question: I’ve heard that Blockchain has many principals and without them it couldn’t be considered a Blockchain, what are they?

Answer: To consider a system a Blockchain network, it must fulfil five principals:

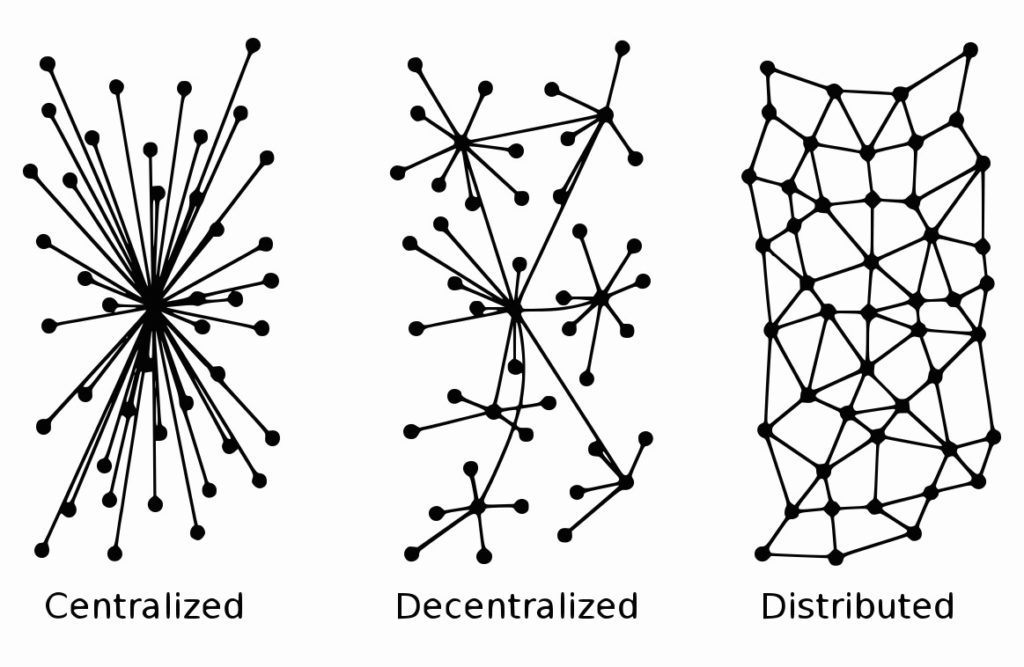

- Distributed: across all the peers composing the network, Blockchain is distributed and every node has a copy of the last ledger version. We have to be aware of the difference among a centralized, decentralized and distributed systems. Blockchain is absolutely distributed.

- Public: in public Blockchain like Bitcoin, the actors are hidden but everyone can see the transactions. Nevertheless, we are seeing closed Blockchain networks where transactions are only seen by the members of the network. One example could be the Blockchain network set among a retail distributor and their suppliers.

- Persistent: because of the consensus and the distributed principal, Blockchain networks are persistent, can’t catch fire, damaged by water or misplaced.

- Timestamped: the dates and times of all transactions are stored in plain view.

- Immovable: all blocks of transactions added in the network couldn’t be removed in a future.

If one of these 5 principals aren’t met, the network couldn’t be considered a Blockchain.

Question: It seems that Blockchain has a short history, right?

Answer: Blockchain appearance is linked to Bitcoin. Blockchain was first mentioned in 2009 in Satoshi Nakamoto article and was coined years after. In 2013, while Bitcoin still had many negative connotations around it, Blockchain became a respectable word when it comes to technology. In 2014, Blockchain starts to be used separately from cryptocurrency to reference distributed ledgers and databases. In 2015, Ethereum as the first Blockchain network beyond cryptocurrencies was created and the concept of Smart Contracts and Decentralized Applications (dApp) appears and Blockchain starts to be open to every industry and since then, large companies, governments and start-ups are immersed in adapting their systems and operations to the new hype.

Question: If you have to convince a business man, entrepreneur or manager to harness the benefits Blockchain Technology could bring to their business, what would you tell them?

Answer: Blockchain would be worth and adds value only in case of storing and protecting information of valuable assets. If that’s the case, go for it.

- Trust: Blockchain allows intermediaries to be removed while still maintaining trust and security between people involved in the transaction.

- Security: Data entered into Blockchain is immutable. Every block of data on the blockchain can be tracked back to the first genesis block. This fact creates an easy way to follow audit trail of every transaction on the Blockchain. Altering an existing transaction require controlling over 50% of the computers (the 51% attack) on the network at the same time which is completely unfeasible. If this occurs, it would be immediately spotted by other members.

- Increased Transaction Speed: Transferring assets and property takes much less time than the traditional way because of avoiding third parties such as banks, notaries, government’s bureaucracy.

- Transparency: Changes to the ledger are visible and easily detectable to everyone on the network, and the transactions can’t be altered or deleted once entered into the Blockchain. This magic effect is unattainable with existing databases with lack of transparency. The majority of the components connected to the Blockchain must accept new transactions preventing transactions from being hidden or manipulated.

- Removal of intermediaries and reduced costs: Maintaining ledgers or databases is costly and often extremely manual process with many people involved in checking the integrity of each ledger. By removing intermediaries involved in the process of recording and manipulating assets, a distributed ledger allows parties to transfer assets on one shared ledger, reducing the costs of maintaining multiple ledgers.

- Decentralization: Blockchain are maintained on a single shared ledger instead of multiple ledgers that are shared by multiple institutions. Centralized databases are prone to hacking, data loss and corruption. Blockchain has no central database that is a point of failure and manipulation. All the members (nodes) of the network have the same copy the last ledger.

- Wide range of uses: Beyond financial sector, almost everything of value can be recorded on the Blockchain: ownership, digital identity, copyright licence, etc. Let’s develop this point later.

Question: Almost everything in life has its advantages and drawbacks, being relatively a new technology, I imagine it has its own downsides or weakness, what are they?

Answer: Of course, Blockchain has a range of limitations.

- Lack of privacy: Decentralized Blockchain systems lack privacy. The information is not private and it’s readily accessible at any given moment to anyone using the system. On the same path, many cryptocurrencies based on Blockchain are hold by computers located in countries such as Russia and China where computer crime is high and personal information could frequently used against people living or traveling to those countries.

- Blockchain vs. GDPR (General Data Protection Regulation): As a resume of recitals 65 (the right to erasure / be forgotten) and 66 (the right to rectification) of GDPR: A data subject should have the right to have his or her personal data no longer processed where the personal data are no longer necessary in relation to the purposes for which they are collected or otherwise processed. If the same subject data is stored into the Blockchain, it breaks the GDPR, because once an information is stored into the Blockchain, there is no reverse. This fact could be avoided inserting only the Hash code (digital fingerprint) of the information piece instead of the information itself.

- Regulation and integration: The government of Estonia is successfully testing Blockchain based systems in government services, but Estonia has a population of 1.5 million. There are cities in USA or China with more than 10 times this population. While Blockchain based systems may work on a small scale, it’s not as easy to integrate on the scale needed for governments with larger populations.

- Risk of 51% attack: If someone were able to control over 50% of the computers on a Blockchain network, they would control all transactions, even manipulate already inserted blocks. This fact is known as 51% attack. The majority of computers of the Blockchain networks are located in countries with a flawless democracy and high crime rates, if those countries collaborated, they could for sure take over the whole Blockchain network.

- No centralized control: Blockchain based systems are designed to replace third party intermediaries, putting the responsibility and control back with the individuals involved in transactions. With a traditional network and software, if an organisation wants to make a change, they can do it only after approval of relevant departments/managers within the organisation. This makes decentralized networks risky for organisations to use.

- Lack of understanding of its core technology: Many managers are still sceptical about Blockchain benefits because of the lack of real-world applications feedback and the non-understanding of its core technology.

- Scalability issues: In Bitcoin, a block is added every 10 minutes, each block contains around 2.000 transactions, that means Bitcoin is processing around 3,33 transactions a second, a ridiculous figure. In Ethereum, this number rises to 125 transactions/s, but it’s still pathetic. Visa has conducted tests with IBM concluding the Visa network is capable of handling over 20.000 transactions a second. Comparing both systems, Blockchain based systems are far away from Visa network when it come to productivity.

- Unproven new technology: There is still a lack of real-world applications that are currently in existence to prove the effectiveness of the technology. For sure, the technology is new with a lot of potential, but we still have no real and strong feedback about its use.

- Hype: A lot of writings about Blockchain are overrated or over-hyped, stating that Blockchain will be the solution to all world’s problems, will disrupt governments, eliminates banks, solve world poverty, etc. It’s easy to get caught in the hype of a new technology. On the other hand, experts state the beginning of the internet was somehow similar to Blockchain when it comes to hype, and internet changed the world… I think Blockchain technology is just a new way of storing and managing data. It isn’t the answer to all world’s troubles, so, please let’s be sensible, don’t believe all the hype surrounding Blockchain.

- Reputation and Trust: There is still a lack of understanding about how the Blockchain works along with a dull reputation from the connection with Bitcoin. When it is each time more accepted as a legal payment method, terrorism and computer crime bring Bitcoin back into the news reiterating that unfair link. A not long past example is the computer networks at the National Health Service in U.K. A computer virus locked the computers of the NHS, preventing them from being used and accessed unless a ransom was paid in Bitcoin. This way Bitcoin was linked again to crime.

Question: People think Blockchain is always tightly linked to Finance Industry, especially cryptocurrencies, is that true?

Answer: Blockchain was born in a financial environment and financial services industry is one of the first industries to accept and leverage the benefits of Blockchain. Today, NASDAQ, Japan Exchange and Euronext have already developed their own Blockchain-based systems. Visa, Citibank, Capital One and Santander have invested over $30 million in Blockchain-based applications. Ripple (payment network that can be used to transfer different currencies, commodities or anything of value) is based on Blockchain (15 of the world’s top 50 banks are working with Ripple). In 2018, Bank of England announced they will set up a dedicated R&D team to the Blockchain. But many other sectors are harnessing Blockchain. Therefore, the response to your question is: many cryptocurrencies like Bitcoin are Blockchain-based systems, but Blockchain isn’t cryptocurrencies-based system. In other words, Blockchain is one the cornerstones of cryptocurrencies, but not vice-versa.

Question: Let’s talk about Blockchain and industries other than Finance, Blockchain is everywhere, every day we have news about companies from various sectors leveraging Blockchain’s potential, tell me 4 or 5 industries where Blockchain has had a good acceptance and really brings a clear added value.

Answer: It’s somehow daring to say Blockchain is suitable or appropriate to all and every industry, that’s because there are sectors where Blockchain doesn’t bring a real added value or simply because of a lack of research on Blockchain opportunities in this sector. To mention a few, we can see real uses in Travel industry, Property, Healthcare and Medical Records, Digital Voting, Identity Management, Academic Scores and Certificates, Predictions and Gambling, Food Track, Civil Aviation, Insurance, Car Leasing and Rentals, Cloud Storage, Loyalties, Supply Chains, etc. In essence, in sectors of valued assets.

Question: What about the Smart Contracts and Decentralized Applications, what are they and how are they related to Blockchain?

Answer: Decentralized Applications or simply dApps are small open source applications, not controlled by one person or entity and run across a distributed Blockchain network (for example Ethereum). dApps have no central server or entity controlling it. Even if one computer on the network is hacked, it can’t make unauthorised changes to the application as the majority of the network must agree to changes to be accepted. These applications have the characteristic to be decentralized and peer-to-peer, this fact allows to everyone create and distribute them with no necessity to approval or validation of any company (i.e. Apple Store, Play Store, etc.).

On the other hand,Smart Contracts aren’t more than contracts written in machine code and are executed in a Blockchain distributed ledger. They automatically verify, execute and enforce the contract based on the terms written in the code. They can be partially or fully self-executing. If the pre-set conditions are met, payments or value are transferred based on the terms of the contract. Many consider them a virtual agreement of transactions of services or assets which bring legal guarantee. The basic principle of Smart Contracts is simply the famous algorithm “IF-THIS-THEN-THAT”.

Just like people and companies that reach agreements in natural language, and may or may not take traditional contracts on paper, Smart Contracts replicate this same logic automatically, in a distributed way, with less chance of disagreement and with more reliable and solid results, since these are executed in a Blockchain (essential condition so that we can speak of Smart Contract and not of simple computer program) and conditions that trigger value transfer are meticulously coded.

As I’ve said, in a Smart Contract, there is no confusion when it comes to check the conditions, for example, if the condition to trigger the transference of an assert is transferring 10.000 euros from account A1 to account A2 on a specific day D, the fact to transfer 5.000 euros two times or transfer 10.000 euros other day than day D or transfer an amount greater than 10.000 euros, the condition wont be met and the asset won’t be transferred. Let’s say this is one of the advantages of Smart Contracts: there is no room for confusion or fuzzy interpretation of events like in real contracts.

We could say the software of a vending machine is a very simple and rudimentary case of Smart Contract (although it depends completely on the confidence that we will obtain the product when introducing the currency). The machine is constantly listening to possible events: selecting a staff or inserting coins. Once a staff is selected and coin is introduced, the first chunk of code to execute is checking whether the balance (introduced coins sum) is greater or equal than the selected staff’s price, if so, the machine delivers the staff. Once the staff is delivered, the last code chunk to execute is checking whether the balance minus staff’s price is greater than zero, if so, the machine returns the difference. It’s as simple as this, isn’t it?

Question: How do Smart Contracts work?

Response: A series of inputs or values predefined by both parties are selected when coding Smart Contracts. It is important that the code and the possible outputs fulfil the requirements and expectations of the parties. Therefore, the logic of the contract must strictly coincide with these. Once the Smart Contract is coded, it will spread on the network and will be integrated into the Blockchain for execution. The Smart Contract remains checking conditions to check whether they are met or not, if so, the outcomes coded are executed (transferring assets). The Smart Contract parties remain anonymous; however, the contract is public. They could have an expiration date.

Question: I can imagine the benefits of Smart Contracts regarding to traditional contracts. What could you tell to people who still have doubts about Smart Contracts?

Response: Simply put, Smart Contracts are all advantages:

- More precision and less ambiguity: If a Smart Contract is well coded, it will be executed with no errors nor time lose. There should be no further confusion regarding its outcome, or possible ambiguous interpretations of such results, so this makes Smart Contracts do not need litigation after their execution.

- Get rid of trusted 3rd parties: Since the conditions of the contract are checked automatically, with Smart Contract we get rid of third parties. An ordinary contract always run along a third party; with the disadvantages this fact entails.

- Security: Provided by the Blockchain, it makes Smart Contracts safe from possible losses, theft, destruction, manipulation, etc.

- Velocity: In this type of contracts there are no waiting times for validation or verification by intermediaries, because simply there are no intermediaries. Smart Contracts greatly reduce waiting times for revision, validation, authentication and various bureaucracies

- Consistency: Since all the parties involved in the contract can be sure that all are seeing the same activity and the same results at all times, thus eliminates the uncertainty and associated risks in cost of possible inconsistencies in conditions and outcomes.

- Traceability: We can check in which state a Smart Contract is and the progress of the coded conditions.

- Accountability: Decentralization and immutability of the contracts (due to Blockchain) are the strong points of these contracts and their growing popularity. The parties involved in the operation can know at all times what state the contract is in.

Question: Well explained. But, do Smart Contracts have any downside?Answer: I wouldn’t say downsides but limitations:

- Non spread Blockchain culture: Blockchain and Smarts Contracts are still on the way to be well known and accepted.

- Non access to external network: Smart Contracts couldn’t check external information such as weather information, stock exchanges rates, flights delays, elections results, etc. This is why it’s necessary to connect them with other components called Oracles to obtain certain needed information to execute the Smart Contract.

- Legal Issues: When parts aren’t in the same territory, legislations regarding Smart Contracts could be different in each territory. This fact could add ambiguousness when it comes to legal files. To avoid this possible issue, legal experts suggest to add a clause in the same Smart Contract to define which legislation is applicable in case of disagreements. Other fact affecting to this is the platforms (Ethereum, Hyperledger, etc.) when Smart Contracts are located and run have no known location.

- GDPR: Information inserted in Smart Contracts is immutable. This fact could collide with recitals 65 (the right to erasure / be forgotten) and 66 (the right to rectification) of the General Data Protection Regulation.

Question: Which sectors leverage the advantages of Smart contracts or which ones use the Smart Contract the more?

Answer: Microfinance, Micro-Insurance, Flight-delay insurance, Voting Systems, Mortgage, Supply Chain, Real Estate Market, Healthcare Services, Insurance Claim, among others.

Question: Now, we have a large transversal vision of Blockchain and Smart Contracts, could you tell me some real use case?

Answer: The net is full of use cases of Blockchain, many of them are provable cases and many just speculations or pre-projects. I’ll show you some real noteworthy cases of use.

Use case 1. Agriculture: Decentralized insurance for farmers based on Smart Contracts (Etherisc).

Coverage is set on a specific period, it could be monthly, fortnightly or on the whole season (usually from September to May). The insured is covered from flood and drought. On a specific day (agreed in the Smart Contract), the Smart Contract checks precipitations and average temperature from a Weather Data provider such as a recognised weather station or the National Institute of Meteorology (agreed in the Smart Contract) to verify whether certain conditions are met or not. It generates a report to be sent to the insured. In case of compensation, the Smart Contract triggers the payment of the compensation and the insured receives the money agreed in the policy.

Use case 2. Civil Aviation: Flight delay insurance based on Smart Contract

AXA, the huge insurance company and perhaps the largest financial company in the world, with total assets of one trillion dollars and an annual income of $ 6 billion, has launched an insurance product based on Smart Contracts in the public Blockchain Ethereum. The product is called Fizzy but it’s known as FlightDelay, whereby the insured pays a small fee, then automatically receives compensation if the flight has a delay of more than two hours. The automatic part is dealt by the Smart Contract through the simple principle “IF-THIS-THEN-THAT”, while flight data is provided by third parties (mainly IATA) and linked through different means with the Smart Contract. The fee to pay depends on the aviation company punctuality index, season (flights are prone to delays in Christmas and summer) and destinations, specially crowded ones.

Use case 3. Healthcare: Insurance based on Smart Contract

The patient buys the insurance with coverage, when there has been intervention or care that is covered in one of the associated hospitals, he pays for it, executes the Smart Contract for the return. The Smart Contract checks the information of the hospital where the intervention took place and reimburses an amount based on the contracted conditions. All patient medical records are inserted in the Blockchain and both hospitals and patient can turn to it if necessary.

Robomed Network is a pioneer start-up in bringing Smart Contracts to healthcare sphere. Smart Contract accomplishment secure the proper course of patient’s treatment and reaches the effect desired.

Use case 4. Food track: Ambrosus